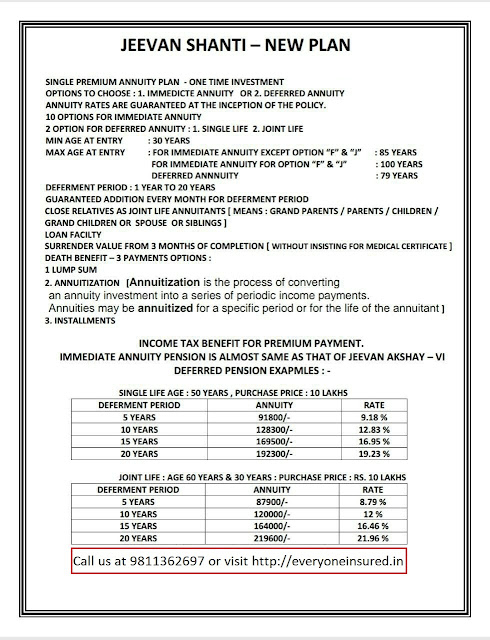

LIC Jeevan Shanti - Single Premium Annuity Plan - One Time Investment

Options to choose:

1. Immediate annuity or2. Deferred annuity rates are guaranteed at the inception of the policy.

10 options for immediate annuity

2 option for deferred annuity: 1. Single life 2. Joint life

Min age at entry: 30 years

Max age at entry: for immediate annuity except option "f" & "1”: 85 years

For immediate annuity for option "f" & "j”: 100 years

Deferred annuity: 79 years

Deferment period: 1 year to 20 years

Guaranteed addition every month for deferment period.Close relatives as joint life annuitants [means: grandparents / parents / children / grand children or spouse or siblings]

LIC Jeevan Shanti Loan facility

Surrender value from 3 months of completion [without insisting for medical certificate] death benefit - 3 payments options:

1. Lump sum.2. Annuitization [annuitization is the process of converting an annuity investment into a series of periodic income payments. Annuities may be annuitized for a specific period or for the life of the annuitant]

3. Installments.

Income Tax Benefit for Premium Payment

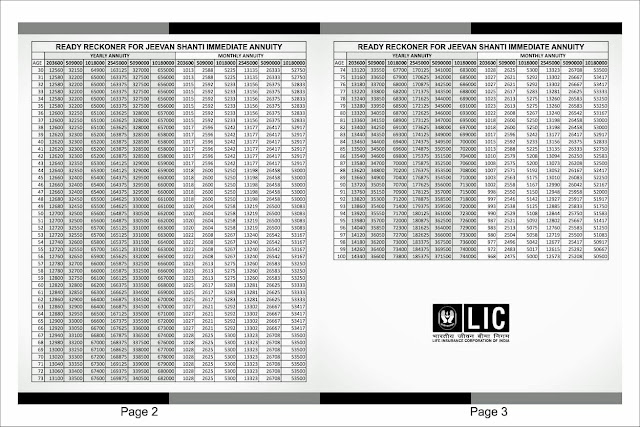

LIC Jeevan Shanti Premium Chart Details

Immediate annuity pension is almost same as that of Jeevan Akshay - VI

Deferred Pension Examples: -

Single life age: 50 years, purchase price: 10 Lakhs

Deferment Period

|

Annuity

|

Rate

|

5 Years

|

91800/-

|

9.18 %

|

10 Years

|

128300/-

|

12.83 %

|

15 Years

|

169500/-

|

16.95 %

|

20 Years

|

192300/-

|

19.23 %

|

Joint life: age 60 years & 30 years: purchase price: Rs. 10 Lakhs

Deferment Period

|

Annuity

|

Rate

|

5 Years

|

87900/-

|

8.79 %

|

10 Years

|

120000/-

|

12 %

|

15 Years

|

164000/-

|

16.46 %

|

20 Years

|

219600/-

|

21.96 %

|

LIC Jeevan Shanti - Single Premium Annuity Plan - One Time Investment Details

LIC Jeevan Shanti Plan No 850 Proposal Form

LIC Jeevan Shanti Plan Surrender Value

The policy can be surrendered at any time after three months from the completion of policy (i.e. 3 months from the Date of issuance of policy) or after expiry of the free-look period, whichever is later under the following annuity options only:

a. Immediate Annuity

i) Option F: Immediate Annuity for life with return of Purchase Price.

ii) Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

b. Deferred Annuity

i) Option 1: Deferred annuity for Single life

ii) Option 2: Deferred annuity for Joint life

If the chosen annuity option is other than specified above, surrender of policy shall not be allowed. On the payment of the surrender value, the policy shall terminate and all other benefits shall cease.

The surrender value payable shall depend on the age (last birthday) of the Annuitant at the time of surrender/date of vesting of the policy.