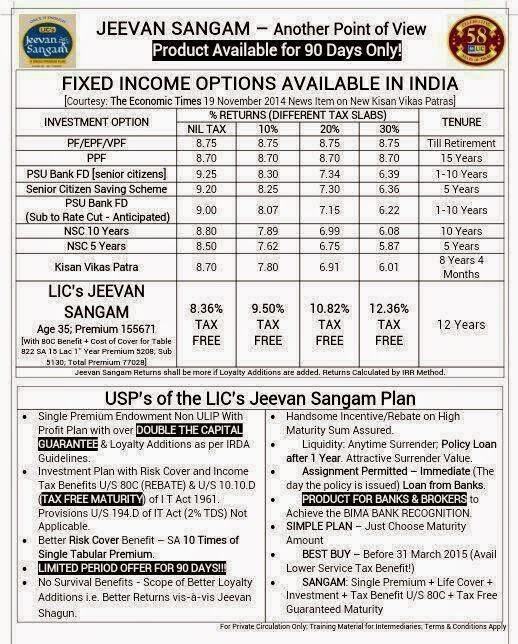

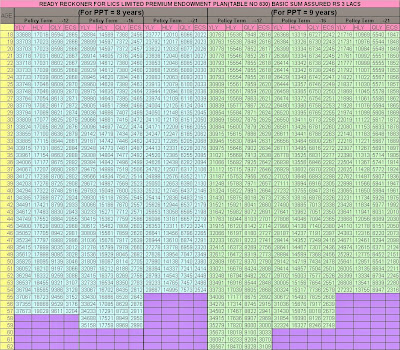

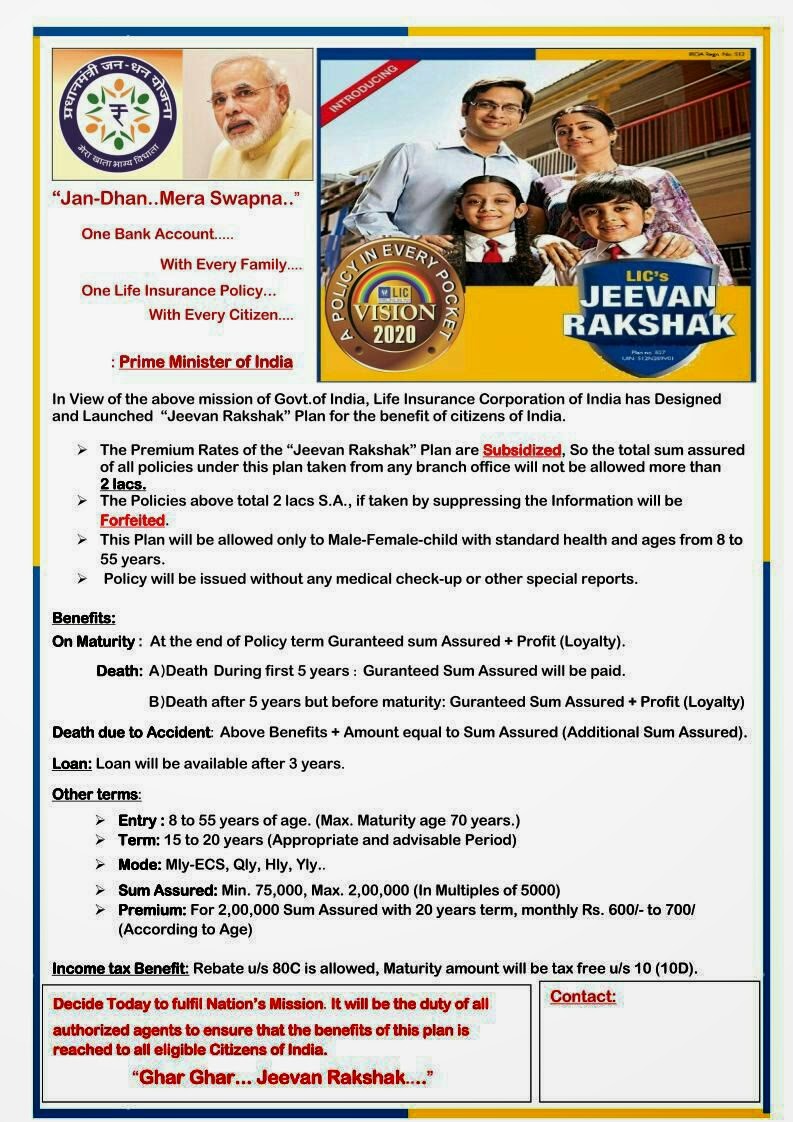

Lic Jeevan Sangam Single Premium Payment Plan Table No 831 Details

1. Introduction:

It

has been decided to introduce LIC’s JEEVAN SANGAM (Plan No.831), a close ended plan which would

be open for sale from 4th March, 2015 for a maximum period of 90 days.

LIC’s Jeevan Sangam is a non-linked,

with-profit, single premium plan which provides for high level of death cover during the

policy term.

Under this plan, the

Proposer/ Life Assured will have an option to choose the Maturity Sum Assured

and the single premium payable will depend on the chosen amount of Maturity Sum

Assured and age of the life assured.

The benefits and other details of this plan are

given below.

2. Benefits:

a) Death

Benefit:

On death during first five

policy years:

Before the

date of commencement of risk: Refund of single premium

excluding service tax and extra premium, if any, without interest.

After the date of commencement of risk: Basic Sum assured i.e. 10

times the tabular single premium shall be payable.

On death after completion of

five policy years but before the stipulated Date of

Maturity:

Basic Sum assured i.e. 10 times

the tabular single premium along with Loyalty Addition, if any, shall be

payable.

The Tabular single premium mentioned above

does not include any extra premium or taxes and is before applying any rebate.

b) Maturity:

On the Life Assured surviving to the end of the

policy term, the Maturity Sum Assured along with Loyalty Addition, if any,

shall be payable.

c) Loyalty Addition:

The policies under this plan

shall be eligible for share in surplus (profits) in the form of Loyalty

Addition, depending upon the experience of the Corporation. The Loyalty

Addition, if any, shall be payable at such rate and on such terms as may

be declared by the Corporation, on death or surrender, provided the policy has

run for at least five policy years or on

policyholder surviving to the maturity.

3. Eligibility Conditions

and Restrictions:

a)

Minimum Entry Age : 6 years (completed)

b)

Maximum Entry Age : 50

years (nearer birthday)

c)

Mode of premium payment : Single premium

d)

Minimum Maturity Sum Assured :

Rs.75,000/-

e)

Maximum Maturity Sum Assured :

No Limit

f)

Policy Term :

12 years

Except for minimum Maturity Sum Assured of Rs.75000/-, higher Maturity

Sum Assured than this amount shall be in multiple of Rs. 10000/- only.

Date of commencement of

risk: In case the age at entry

of the Life assured is less than 8 years nearer birthday, the risk under this

plan will commence from one day before the policy anniversary coinciding with

or immediately following the age of 8 years (nearer birthday).

For those aged 8 years (nearer birthday) or

more, risk will commence immediately.

4. Rebates:

High Maturity Sum Assured Rebate:

Maturity Sum Assured

(M.S.A) chosen under the policy

|

Reduction in Tabular

premium (per Rs. 1000/- Maturity Sum Assured)

|

Below Rs.2,00,000

|

Nil

|

Rs.2,00,000 to Rs. 3,90,000

|

Rs. 15.00

|

Rs.4,00,000 and above

|

Rs. 20.00

|

5.

Surrender

Value:

The policy can be surrendered at any time during

the policy term subject to realization

of the premium cheque.

Guaranteed

Surrender Value:

The Guaranteed Surrender Value shall be as under:

·

First year: 70% of the Single premium paid

excluding extra premium and taxes, if any.

·

Thereafter: 90% of the Single premium paid

excluding extra premiums paid and taxes, if any.

6. Loans:

Loan facility shall be available under the plan at any

time during the policy term after three months of the policy issuance subject

to the following conditions:

a)

Depending on the age at entry, the maximum

loan that can be granted as a percentage of Surrender Value (S.V.) for different policy years in which the loan is applied is as under:

Policy year

|

maximum Loan Amount as a % of surrender

value for age at entry <=45

|

maximum Loan

Amount as a % of surrender value for age at entry >45

|

*3 month to 3rd

|

55%

|

40%

|

4th to 6th

|

70%

|

45%

|

7th to 9th

|

80%

|

65%

|

10th to 12th

|

90%

|

90%

|

*3 month means loan

can be availed after three months of the policy issuance.

b) The rate of interest to be charged on loans granted under this plan would be determined from time to time by the Corporation.

c) In

case the policy shall mature or becomes a claim by way of death, the

Corporation shall become entitled to deduct the amount of the loan or any

portion thereof which is outstanding, together with all outstanding interest

from the policy moneys.

d) No

foreclosure action should be taken under this plan even if there is a default

in payment of loan interest. However, any loan outstanding along with the interest

shall be recovered from claims proceeds at the time of exit.

7.

Suicide

Clause:

The

policy shall be void if the Life Assured (whether sane or insane at the time)

commits suicide at any time within 12 months from the Date of Commencement of

Risk, an amount which is higher of 90% of the single premium paid (excluding

taxes and extra premium, if any) or Surrender Value shall be payable. The

Corporation will not entertain any other claim under this policy.

This

clause shall not apply in case of Life Assured whose age at the time of entry

is below 8 years.

8.

Taxes:

Taxes including service tax,

if any, shall be as per the Tax laws and the rate of tax as applicable from

time to time.

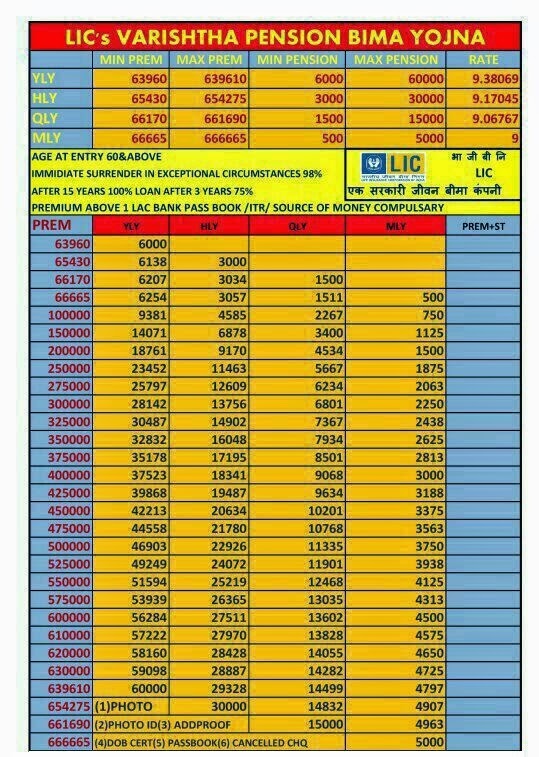

Lic Jeevan Sangam Single Premium Payment Plan Table no 831 Comparison

Lic Jeevan Sangam Single Premium Payment Plan Table no 831 Comparison

Other Plans : LIC New Jeevan Anand Plan Table No - 815, LIC New Endowment Plan Table No - 814