Close Ended Plan - Available for 90 Days only from 01-09-2014 till 29-11-2014.

Lic Jeevan Shagun Single Premium Payment Plan

Jeevan Shagun Benefits:

Death Benefit:

On death during first five policy years:

On death after completion of five policy years:

Survival Benefit:

On Life Assured surviving to the end of the specified durations, the following Survival benefit shall be payable.At the end of 10th policy year: 15% of the Maturity Sum Assured.

At the end of 11th policy year: 20% of the Maturity Sum Assured.

Maturity Benefit:

On maturity, 65% of the Maturity Sum Assured along with Loyalty Addition, if any, shall be payable.

Loyalty Addition:

ELIGIBILITY CONDITIONS AND OTHER RESTRICTIONS:

Maximum Entry Age : 45 years (nearest birthday)

Minimum/Maximum Basic Sum Assured : 10 times of tabular single premium paid

Minimum Maturity Sum Assured : Rs. 60,000/-

Maximum Maturity Sum Assured : No Limit

Maturity Sum Assured shall be available in multiples of Rs. 5,000/-.

Policy Term : 12 years

Premium payment mode : Single premium only

|

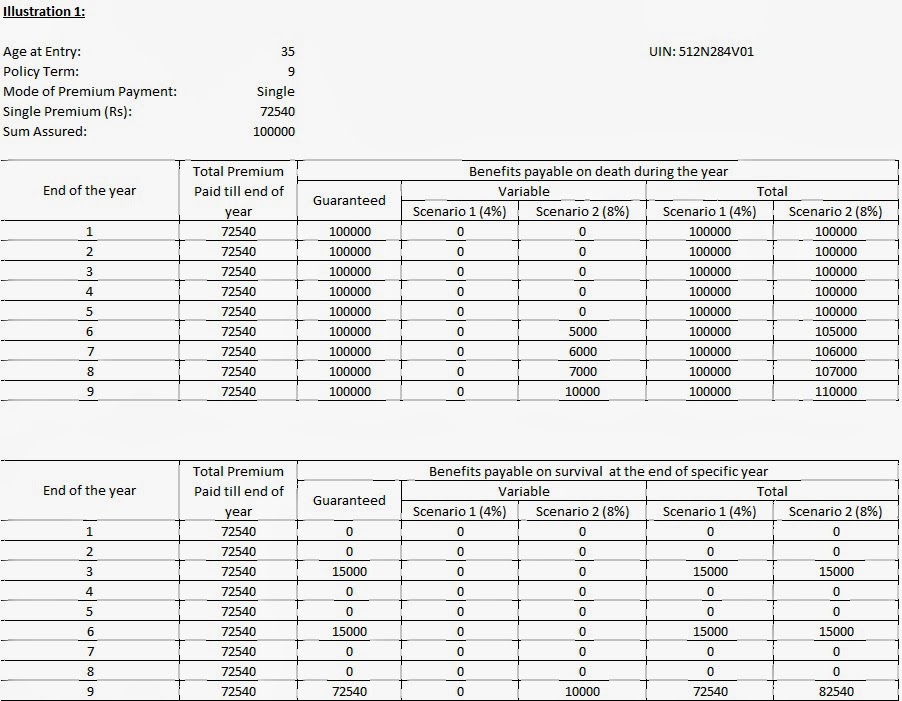

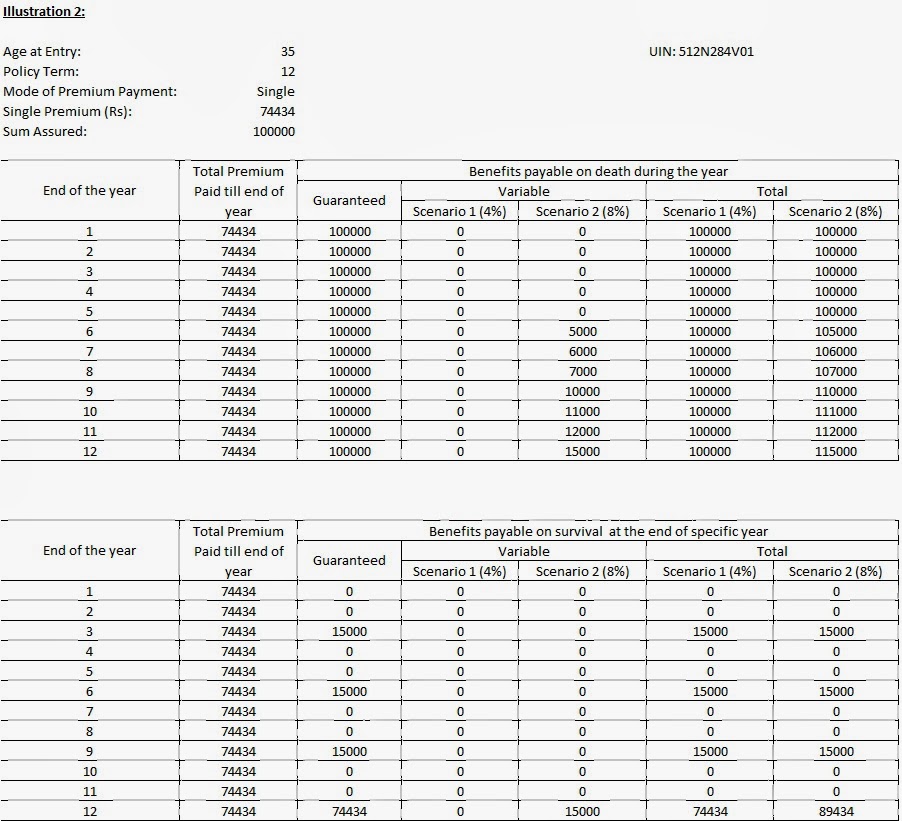

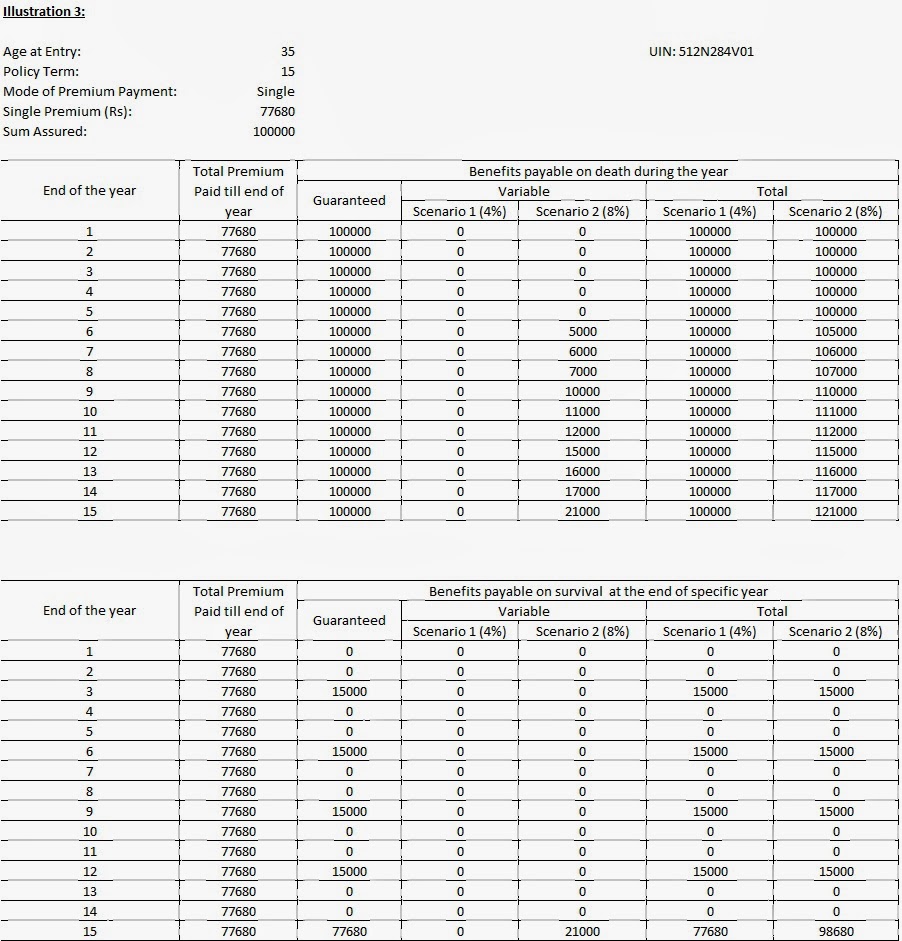

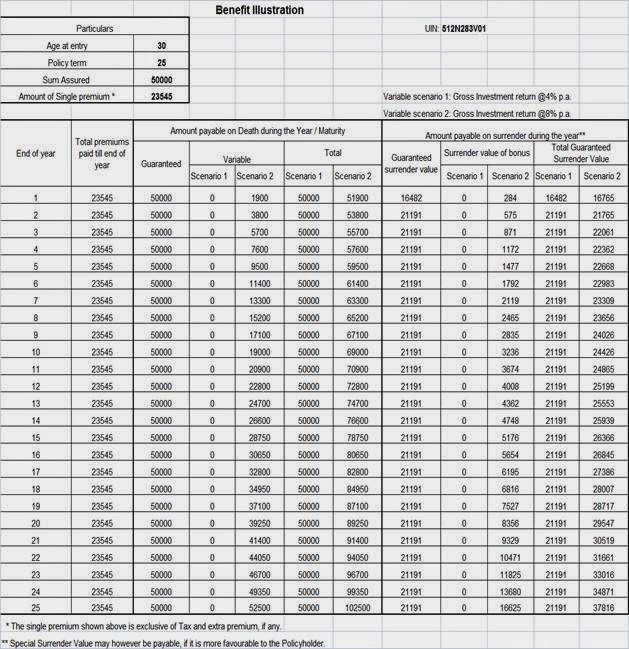

Lic Jeevan Shagun Table no 826 Plan Presentation

Lic Jeevan Shagun Table no 826 Plan Premium Chart

Interested to buy it, please contact at 9811362697.

Related Plans : LIC Single Premium Endowment Plan - 817

Other Plans : LIC New Jeevan Anand Plan Table No - 815, LIC New Endowment Plan Table No - 814