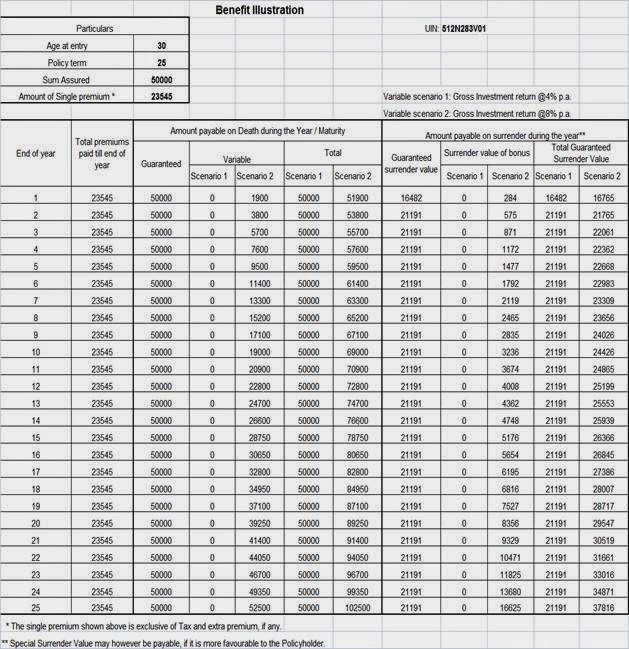

LIC Single Premium Endowment Plan (Table 817)

is a single premium conventional With Profits Endowment Assurance Plan. This

policy will be eligible for Simple revisionary bonus at a rate based on the

corporation's experience with this policy. Final Additional Bonus may also be

declared under this policy which will be payable on the expiry of the policy

term or on earlier death provided the policy has completed a minimum no of

years.

|

||||||||||||||||||

Features : |

||||||||||||||||||

• Single Premium plan which participates in the corporation's profits and is eligible for Simple reversionary Bonus • On survival of the policy holder till the end of the policy term, Sum Assured with Simple Reversionary Bonus along with Final Additional Bonus(if any) will be provided. • The Life risk coverage starts after the policy holder completes 8 yrs of Age. |

||||||||||||||||||

Eligibility Conditions : |

||||||||||||||||||

|

||||||||||||||||||

LIC New Single Premium Endowment Plan Returns : |

||||||||||||||||||

Maturity / Survival Benefit – At the maturity of the policy, the

policy holder will get Sum Assured + Simple Reversionary Bonus + Final

Additional Bonus (if any). In totality you will get maturity amount.

|

||||||||||||||||||

Death Benefit –

· In case of death

after the commencement of risk, nominee will receive the Sum Assured with accured

Bonus and Final Additional Bonus if any.

· In case of death before the commencement of risk, The single premium policy will be returned excluding taxes and any extra premium paid. |

||||||||||||||||||

Income Tax Benefit – Available under Section 80 C for

Premiums paid and under Section 10 (10D) for returns

|

||||||||||||||||||

Loan on Policy - Available

|

||||||||||||||||||

- Buy Insurance

- Child Plan

- Endowment Plan

- Money Back

- Single Premium

- Term Plan

- Pension Plan

- ULIP Plan

- Health Plan

- Calculator

-

Closed Plans

- Golden Money Back Policy

- Children's Plan

- Jeevan Anand

- Jeevan Sathi

- Jeevan Tarang

- Jeevan Mithra (Triple Benefit)

- Bima Account -1

- Bima Account -2

- Jeevan Chhaya - 103

- Jeevan Kishore - 102

- Child Future 185

- Child Fortune Plus - 194

- Child Career 184

- Jeevan Saral ATM Plan table no 165

- Jeevan Surabhi (Money Back)

- Jeevan Anurag 168

- Jeevan Anurag

- Komal Jeevan

- Top 10 reasons for Jeevan Nidhi

- Top 10 reason for Jeevan Pramukh

- LIC Policy Status

- Jeevan Saral ATM Plan 825

- Lic Varishtha Pension Bima Yojana Plan 828

- Jeevan Shagun Plan 826

- Jeevan Sangam Plan 831

- Jeevan Sagar Plan 839

- How to Become LIC Agent In Delhi NCR

- Jeevan Shikhar Plan 837

- LIC vs PPF vs LIC Jeevan Anand Vs PPF

- Comparision PPF, KVP, Post Office, Senior citizen savings, Sukanya Samriddhi

- Best LIC Policy

- LIC and LIC Products

- Life Insurance

- LIC Jeevan Saral

Home

»

Posts filed under

Child Plans

Showing posts with label Child Plans. Show all posts

Showing posts with label Child Plans. Show all posts

Friday, January 3, 2014

LIC Single Premium Endowment Plan 817

Saturday, November 9, 2013

Tuesday, June 25, 2013

LIC Komal Jeevan Children Money Back Plan Details & Features

Product summary:

LIC Komal Jeevan is a Children's Money Back Plan that provides financial protection against death during the term of plan with periodic payments on survival at specified durations. LIC Komal Jeevan plan can be purchased by any of the parent or grand parent for a child aged 0 to 10 years.

Commencement of risk cover:

The risk commences either after 2 years from the date of commencement of policy or from the policy anniversary immediately following the completion of 7 years of age of child, whichever is later.

Premiums:

Premiums are payable yearly, half-yearly, quarterly, monthly or through Salary deductions, as opted by you, up to the policy anniversary immediately after the life assured (child) attains 18 years of age or till the earlier death of the life assured. Alternatively, the premium may be paid in one lump sum (Single premium).

Guaranteed Additions:

LIC Komal Jeevan policy provides for Guaranteed Additions at the rate of Rs.75 per thousand Sum Assured for each completed year. The Guaranteed Additions are payable at the end of the term of the policy or earlier death of the Life Assured.

Loyalty Additions:

LIC Komal Jeevan is a with-profit plan and participates in the profits of the Corporation’s life insurance business. It gets a share of the profits in the form of loyalty additions which are terminal bonuses payable along with death or maturity benefit. Loyalty addition may be payable depending on the experience of the Corporation.

Survival Benefit:The percentage of sum assured as mentioned below will be paid on survival to the end of specified durations:

Death Benefit:

In case of death of the life assured before the commencement of risk, the policy shall stand cancelled and premiums paid (excluding the Premium for Premium waiver Benefit ) under the policy will be refunded. However, if death occurs after the commencement of risk but before the policy matures, the full Sum Assured plus Guaranteed Additions together with Loyalty Additions, if any, is payable.

Maturity Benefit:

The Guaranteed Additions together with Loyalty Additions, if any, is payable in a lump sum on survival to the end of the policy term.

Premium Waiver Benefit:

This is an optional benefit that can be added to your basic plan. An additional premium is required to be paid for this benefit. By payment of this additional premium, the proposer can secure the benefit of cessation of premiums from his/her death to the end of the deferment period. The deferment period for this purpose is to be taken as 18 minus age at entry of child.

Surrender Value:

Buying a life insurance contract is a long-term commitment. However, surrender value is available on the plan on earlier termination of the contract.

Guaranteed Surrender Value:

The policy may be surrendered after it has been in force for 3 years or more. The Guaranteed Surrender Value before the date of commencement of risk is 90% of the premiums paid excluding the premiums paid during the first year and any extra premium paid. After the date of commencement of risk, the Guaranteed Surrender Value is 90% of the premiums paid before the date of commencement of risk excluding the premiums paid during the first year and any extra premium paid plus 30% of the premiums paid after the date of commencement of risk.

Corporation’s policy on surrenders:

In practice, the company will pay a Special Surrender Value – which is either equal to or more than the Guaranteed Surrender Value. The benefit payable on surrender reflects the discounted value of the claim amount that would be payable on death or at maturity. This value will depend on the duration for which premiums have been paid and the policy at the date of surrender. In some circumstances, in case of early termination of the policy, the surrender value payable may be less than the total premium paid.

The Corporation reviews the surrender value payable under its plans from time to time depending on the economic environment, experience and other factors.

Illustration 1

Age at entry: 0 years

Premium Paying Term: 18

Years Annual Premium: Rs. 7281/-

Policy Term: 26 Years

Sum Assured: Rs. 1,00,000 /-

Illustration 2Age at entry: 0 years

Premium Paying Term: 1 Year

Single Premium: Rs. 73,980/- Policy Term: 26 years

Sum Assured: Rs. 1,00,000/-

LIC Komal Jeevan is a Children's Money Back Plan that provides financial protection against death during the term of plan with periodic payments on survival at specified durations. LIC Komal Jeevan plan can be purchased by any of the parent or grand parent for a child aged 0 to 10 years.

Commencement of risk cover:

The risk commences either after 2 years from the date of commencement of policy or from the policy anniversary immediately following the completion of 7 years of age of child, whichever is later.

Premiums:

Premiums are payable yearly, half-yearly, quarterly, monthly or through Salary deductions, as opted by you, up to the policy anniversary immediately after the life assured (child) attains 18 years of age or till the earlier death of the life assured. Alternatively, the premium may be paid in one lump sum (Single premium).

Guaranteed Additions:

LIC Komal Jeevan policy provides for Guaranteed Additions at the rate of Rs.75 per thousand Sum Assured for each completed year. The Guaranteed Additions are payable at the end of the term of the policy or earlier death of the Life Assured.

Loyalty Additions:

LIC Komal Jeevan is a with-profit plan and participates in the profits of the Corporation’s life insurance business. It gets a share of the profits in the form of loyalty additions which are terminal bonuses payable along with death or maturity benefit. Loyalty addition may be payable depending on the experience of the Corporation.

Survival Benefit:The percentage of sum assured as mentioned below will be paid on survival to the end of specified durations:

| On the policy anniversary immediately following the Life assured attains the age of | % of Sum Assured |

| 18 years | 20% |

| 20 years | 20% |

| 22 years | 30% |

| 24 years | 30% |

Death Benefit:

In case of death of the life assured before the commencement of risk, the policy shall stand cancelled and premiums paid (excluding the Premium for Premium waiver Benefit ) under the policy will be refunded. However, if death occurs after the commencement of risk but before the policy matures, the full Sum Assured plus Guaranteed Additions together with Loyalty Additions, if any, is payable.

Maturity Benefit:

The Guaranteed Additions together with Loyalty Additions, if any, is payable in a lump sum on survival to the end of the policy term.

Premium Waiver Benefit:

This is an optional benefit that can be added to your basic plan. An additional premium is required to be paid for this benefit. By payment of this additional premium, the proposer can secure the benefit of cessation of premiums from his/her death to the end of the deferment period. The deferment period for this purpose is to be taken as 18 minus age at entry of child.

Surrender Value:

Buying a life insurance contract is a long-term commitment. However, surrender value is available on the plan on earlier termination of the contract.

Guaranteed Surrender Value:

The policy may be surrendered after it has been in force for 3 years or more. The Guaranteed Surrender Value before the date of commencement of risk is 90% of the premiums paid excluding the premiums paid during the first year and any extra premium paid. After the date of commencement of risk, the Guaranteed Surrender Value is 90% of the premiums paid before the date of commencement of risk excluding the premiums paid during the first year and any extra premium paid plus 30% of the premiums paid after the date of commencement of risk.

Corporation’s policy on surrenders:

In practice, the company will pay a Special Surrender Value – which is either equal to or more than the Guaranteed Surrender Value. The benefit payable on surrender reflects the discounted value of the claim amount that would be payable on death or at maturity. This value will depend on the duration for which premiums have been paid and the policy at the date of surrender. In some circumstances, in case of early termination of the policy, the surrender value payable may be less than the total premium paid.

The Corporation reviews the surrender value payable under its plans from time to time depending on the economic environment, experience and other factors.

Illustration 1

Age at entry: 0 years

Premium Paying Term: 18

Years Annual Premium: Rs. 7281/-

Policy Term: 26 Years

Sum Assured: Rs. 1,00,000 /-

Illustration 2Age at entry: 0 years

Premium Paying Term: 1 Year

Single Premium: Rs. 73,980/- Policy Term: 26 years

Sum Assured: Rs. 1,00,000/-

Friday, June 14, 2013

Thursday, June 6, 2013

Friday, March 1, 2013

LIC Children's Plan Details & Features

LIC Child plan are design to give good and financially secured life to your child. LIC Children plan gives you option to choose to fit your need, such as listed in below list.

It is the Premium Waiver advantage that secures your child upcoming if something unlucky happens to you. This makes them interesting, and a worth investing your money.

LIC Child Plan Currently Available Products to Purchase

1) LIC Jeevan Anurag – LIC Jeevan Anurag is plan designed for the children educational requirements. This plan can be taken on the parent’s life. The basic sum assured is given immediately on the death of the life assured during the term of the policy.

2) LIC Jeevan Kishore – LIC Jeevan Kishore is a plan which can be availed by the parent or grand parents of the children. It is an endowment assurance plan for children of less than 12 years of age.

3) LIC Jeevan Chhaya – LIC Jeevan Chhaya is a plan where financial protection is given against death during the term of the plan. LIC Jeevan Chhaya is an Endowment Assurance plan. Besides this benefit one-fourth of Sum Assured is payable at the end of each of last four years of policy term irrespective if the life assured dies or survives the duration of the policy.

4) LIC Komal Jeevan – LIC Komal Jeevan a Money Back Plan which can be bought by the parent or grand parent for their child from the age of 0-10years. LIC Komal Jeevan plan gives financial protection against death during the duration of the plan with periodic payments on survival at specified durations.

5) LIC Child Future Plan – LIC Child Future Plan is a policy where the future needs like education, marriage and other requirements are taken care of. This plan provides a benefit which not only takes care of the risk cover of the child during the policy but also after 7 years of the policy being expired.

6) LIC Child Career Plan – LIC Child Future plan is to meet the educational and other needs of the child. It provides the risk cover on the life of child during the policy term as well as 7 years after the policy has expired. There are also Survival benefits given to the life assured at the end of a specific duration.

7) LIC Children's Deferred Endowment (CDA) Vesting at 21 – This is an Endowment Assurance plan designed to enable a parent , legal guardian or any near relative of the child to provide insurance cover on the life of the child (called life assured).

8 ) LIC Children's Deferred Endowment (CDA) Vesting at 18 – This is an Endowment Assurance plan designed to enable a parent, legal guardian or any near relative of the child to provide insurance cover on the life of the child (called life assured).

Leave a comment on these posts (we LOVE comments) »

It is the Premium Waiver advantage that secures your child upcoming if something unlucky happens to you. This makes them interesting, and a worth investing your money.

LIC Child Plan Currently Available Products to Purchase

1) LIC Jeevan Anurag – LIC Jeevan Anurag is plan designed for the children educational requirements. This plan can be taken on the parent’s life. The basic sum assured is given immediately on the death of the life assured during the term of the policy.

2) LIC Jeevan Kishore – LIC Jeevan Kishore is a plan which can be availed by the parent or grand parents of the children. It is an endowment assurance plan for children of less than 12 years of age.

3) LIC Jeevan Chhaya – LIC Jeevan Chhaya is a plan where financial protection is given against death during the term of the plan. LIC Jeevan Chhaya is an Endowment Assurance plan. Besides this benefit one-fourth of Sum Assured is payable at the end of each of last four years of policy term irrespective if the life assured dies or survives the duration of the policy.

4) LIC Komal Jeevan – LIC Komal Jeevan a Money Back Plan which can be bought by the parent or grand parent for their child from the age of 0-10years. LIC Komal Jeevan plan gives financial protection against death during the duration of the plan with periodic payments on survival at specified durations.

5) LIC Child Future Plan – LIC Child Future Plan is a policy where the future needs like education, marriage and other requirements are taken care of. This plan provides a benefit which not only takes care of the risk cover of the child during the policy but also after 7 years of the policy being expired.

6) LIC Child Career Plan – LIC Child Future plan is to meet the educational and other needs of the child. It provides the risk cover on the life of child during the policy term as well as 7 years after the policy has expired. There are also Survival benefits given to the life assured at the end of a specific duration.

7) LIC Children's Deferred Endowment (CDA) Vesting at 21 – This is an Endowment Assurance plan designed to enable a parent , legal guardian or any near relative of the child to provide insurance cover on the life of the child (called life assured).

8 ) LIC Children's Deferred Endowment (CDA) Vesting at 18 – This is an Endowment Assurance plan designed to enable a parent, legal guardian or any near relative of the child to provide insurance cover on the life of the child (called life assured).

Leave a comment on these posts (we LOVE comments) »

Subscribe to:

Posts

(

Atom

)