lic premium calculator jeevan labh,

lic premium calculator jeevan anand,

lic premium calculator formula,

lic premium calculator xls,

lic premium calculator and maturity,

lic premium calculator,

lic premium calculator term plan,

lic premium calculator bima gold

,best lic premium calculator

,lic jeevan anand premium calculator with benefit illustration

,lic bima bachat single premium calculator

,lic new bima kiran premium calculator

,lic premium calculator chart

,lic premium calculator for child plan 832

,lic premium calculator for jeevan chhaya

,lic child premium calculator

,lic premium calculator excel for jeevan anand

,free lic premium calculator excel

,lic jeevan anand premium calculator excel download

,lic new jeevan anand premium calculator excel

,lic new jeevan anand premium calculator excel download

,lic term plan premium calculator

,lic retire enjoy premium calculator

,lic new endowment premium calculator

,lic premium calculator for jeevan anand

,lic premium calculator for jeevan anand policy

,lic premium calculator for child plan

,lic health premium calculator

,lic health protection plus premium calculator

,lic premium calculator in excel sheet

,lic premium calculator in excel

,lic premium calculator india

,lic premium calculator includes service tax

,lic premium calculator jeevan ankur

,lic premium calculator jeevan lakshya

,lic premium calculator jeevan arogya

,lic premium calculator jeevan saral

,lic premium calculator jeevan surabhi

,lic premium calculator jeevan sugam

,lic premium calculator jeevan shagun

,lic premium calculator komal jeevan

,latest lic premium calculator

,lic lakshya premium calculator

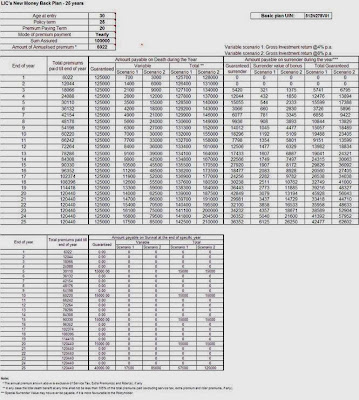

,lic premium calculator money back policy

,lic premium maturity calculator

,lic premium calculator online

,lic premium calculator of jeevan ankur

,premium calculator of lic jeevan saral

,premium calculator of lic jeevan lakshya

,lic of premium calculator

,lic of india premium calculator with service tax

,lic of india premium calculator with maturity amount

,lic premium calculator plan-14

,lic premium calculator plan 814

,lic premium calculator pdf

,lic premium calculator plan 832

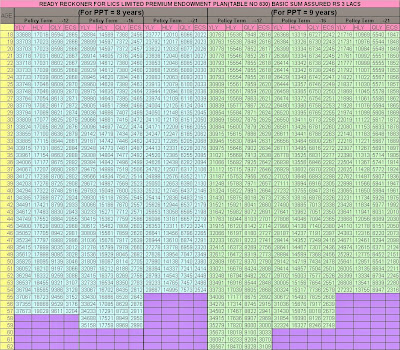

,lic premium calculator plan 830

,lic premium calculator plan 827

,lic premium calculator plan 833

,lic premium payment calculator

,lic premium penalty calculator

,lic premium return calculator

,lic renewal premium calculator

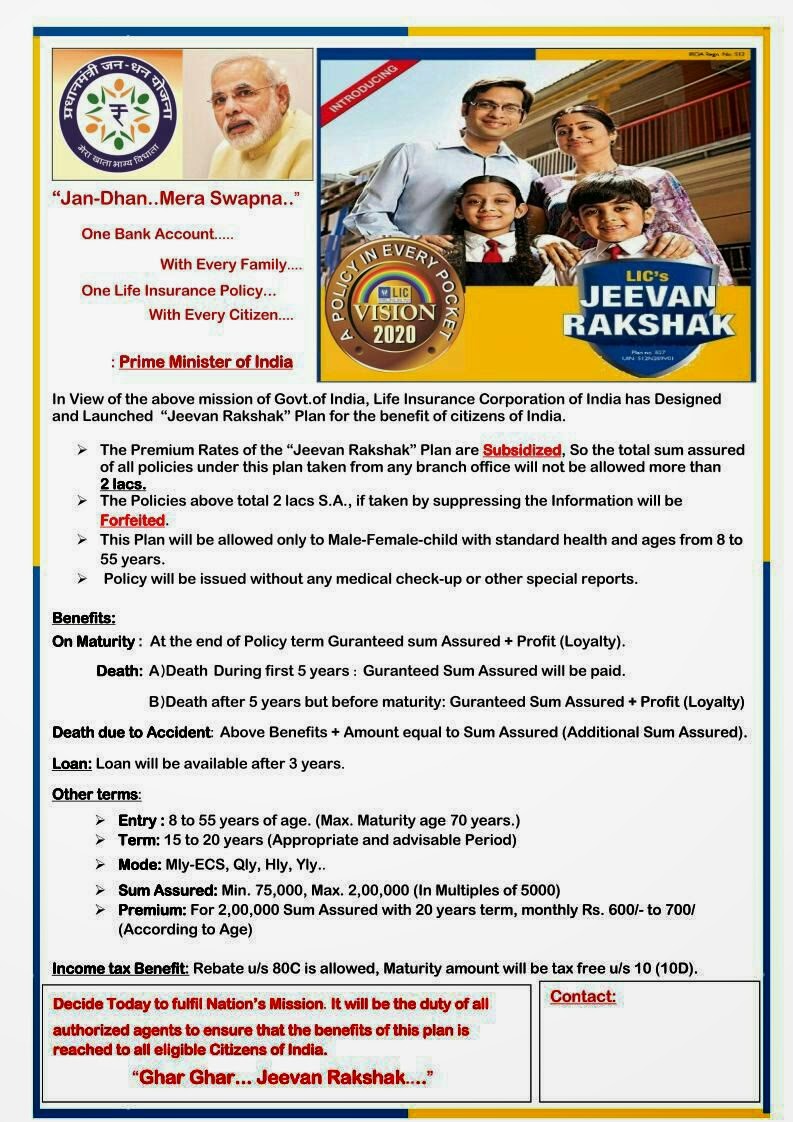

,lic jeevan rakshak plan premium calculator

,lic jeevan rakshak policy premium calculator

,lic premium calculator table 814

,lic premium calculator table 14

,lic premium calculator table 830

,lic premium calculator table 815

,lic premium calculator table 827

,lic premium calculator with tax

,lic premium calculator with service tax

,lic jeevan ankur premium calculator table

,lic premium calculator using policy number

,updated lic premium calculator

,lic premium surrender value calculator

,lic jeevan varsha premium calculator

,lic jeevan vaibhav premium calculator

,lic jeevan vriddhi premium calculator

,lic jeevan akshay vi premium calculator

,lic premium calculator with returns

,lic premium calculator with new service tax

,lic premium calculator with bonus

,lic premium calculator widget

,lic yearly premium calculator

,lic 149 premium calculator

,lic plan 179 premium calculator

,lic table 165 premium calculator

,lic plan 102 premium calculator

,lic plan 178 premium calculator

,lic plan 190 premium calculator

,lic table 164 premium calculator

,lic plan 133 premium calculator

,lic amulya jeevan 1 premium calculator

,lic anmol jeevan 1 premium calculator

,lic jeevan shree 1 premium calculator

,lic premium calculator 2016

,lic premium calculator 2014

,lic premium calculator 2015

,lic new plan premium calculator 2014

,lic premium calculator for amulya jeevan 2

,lic anmol jeevan 2 premium calculator

,lic new policy 2014 premium calculator

,lic amulya jeevan 2 premium calculator

,lic premium calculator for jeevan saral

,lic premium calculator for all plans

,lic table no 5 premium calculator

,lic jeevan akshay 6 premium calculator

,lic premium calculator 832

,lic premium calculator 827

,lic premium calculator 815

,lic premium calculator 830

,lic premium calculator 833

,lic premium calculator 814

,lic plan 904 premium calculator

,lic table no 904 premium calculator